1. What exactly is a mutual fund?

A mutual fund pools money from hundreds and thousands of investors to construct a portfolio of stocks, bonds, real estate, or other securities, according to its charter. Each investor in the fund gets a slice of the total pie.

2. Mutual funds make it easy to diversify.

Most funds require only moderate minimum investments, from a few hundred to a few thousand dollars, enabling investors to construct a diversified portfolio much more cheaply than they could on their own.

3. There are many kinds of stock funds.

The number of categories is dizzying. Some examples: growth funds, which buy shares of burgeoning companies; sector funds, which buy shares of companies in a particular sector, such as technology or health care; and index funds, which buy shares of every stock in a particular index, such as the Philippine Stock Exchange.

4. Bond funds come in many different flavors too.

There are bond funds for every taste. If you want safe investments, consider government bond funds; if you're willing to gamble on high-risk investments, try high-yield bond funds, also known as junk bond funds; and if you want to keep down your tax bill, try municipal bond funds.

5. Returns aren't everything - also consider the risk taken to achieve those returns.

Before buying a fund, look at how risky its investments are. Can you tolerate big market swings for a shot at higher returns? If not, stick with low-risk funds. To assess risk level, check these three factors: the fund's biggest quarterly loss, which will help you brace for the worst; its beta, which measures a fund's volatility against the PSE; and the standard deviation, which shows how much a fund bounces around its average returns.

6. Low expenses are crucial.

In order to cover their expenses - and to make a profit - funds charge a percentage of total assets. At no more than a few percentage points a year, expenses may not sound substantial, but they create a serious drag on performance over time.

7. Taxes take a big bite out of performance.

Even if you don't sell your fund shares, you could still end up stuck with a big tax bite. If a fund owns dividend-paying stocks, or if a fund manager sells some big winners, shareholders will owe their share. Investors are often surprised to learn they owe taxes - both for dividends and for capital gains - even for funds that have declined in value. Tax-efficient funds avoid rapid trading (and high short-term capital gains taxes) and match winning trades with losing trades.

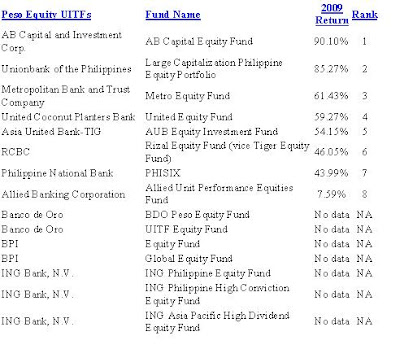

8. Don't chase winners.

Funds that rank very highly over one period rarely finish on top in later ones. When choosing a fund, look for consistent long-term results.

9. Index funds should be a core component of your portfolio.

Index funds track the performance of market benchmarks. Such "passive" funds offer a number of advantages over "active" funds: Index funds tend to charge lower expenses and be more tax efficient, and there's no risk the fund manager will make sudden changes that throw off your portfolio's allocation.

10. Don't be too quick to dump a fund.

Any fund can - and probably will - have an off year. Though you may be tempted to sell a losing fund, first check to see whether it has trailed comparable funds for more than two years. If it hasn't, sit tight. But if earnings have been consistently below par, it may be time to move on.