I decided to segregate or created new site intended for Online Stock Market Trading at http://online-stocktrading.yolasite.com/ a complete and easy to understand step-by-step procedures on trading and investing stocks. This site focus principally to our newbie investors, to guide and enhance skills. I'm also posting my stock picks and advice every week, tips and tricks on trading, and market watch on where we are heading.

I could say that I'm not a stock guru, but I could assure that an elementary newbie level could learned and beat manager on the long run of practice. See you then and more power.

http://online-stocktrading.yolasite.com/

http://online-stocktrading.yolasite.com/

http://online-stocktrading.yolasite.com/

Wednesday, April 21, 2010

Friday, April 9, 2010

MUTUAL FUNDS: 2010 FIRST QUARTER PERFORMANCE

Our mutual funds performs well as a good start this year, with most funds registering a positive results. As we had anticipated, our economy did not go into as bad effect of recession last year, and now show strong recovery despite the financial meltdown in the abroad and in this coming election on May. PSEI also got recovery after a bubble burst last January.

YEAR-TO-DATE PERFORMANCE OF MUTUAL FUNDS IN THE PHILIPPINES

As of the 1st Quarter of 2010 (January to March 2010)

Definitely, 2010 will be a better year for us in to our economy and business. Services sector still seen a continue to provide the major growth, with agriculture and mining that shows strong support. While manufacturing sector continued to decline as we and most countries cannot compete with China.

Link : [HOW TO COMPUTE YOUR EARNING]

Good luck and more power to all our investors.

YEAR-TO-DATE PERFORMANCE OF MUTUAL FUNDS IN THE PHILIPPINES

As of the 1st Quarter of 2010 (January to March 2010)

Definitely, 2010 will be a better year for us in to our economy and business. Services sector still seen a continue to provide the major growth, with agriculture and mining that shows strong support. While manufacturing sector continued to decline as we and most countries cannot compete with China.

Link : [HOW TO COMPUTE YOUR EARNING]

Good luck and more power to all our investors.

Thursday, April 8, 2010

BONDS : PAG-IBIG HOUSING BOND

, Ge( 5.0% government guaranteed and tax-free)

If you’re looking for an investment that make you sleep soundly and no time to study and monitor, then this is it! Invest with our government.

The Bonds have a term of 5 years and 1 day. You can invest with a minimum of Php10,000 only with other denominations are Php100,000, Php500,000, Php1,000,000 and Php10,000,000.

It pays fixed interest rate of 5.0% per year and the interest payments are exempt from the 20% withholding tax. Your earnings are automatically credited every 6 months to the savings account of the bondholder with the Development Bank of the Philippines (DBP) or Land Bank of the Philippines (LBP).

Sample computation:

• Investment Amount: Php10,000

• Coupon rate: 5% fixed per annum

• Gross Semiannual Interest: Php250.00 (Php10,000 x 5.00% x 1/2)

• Tax: None

• Net Interest to be Received: Php250.00 every 6 months

Or for Php100,000 you can gain interest of Php5,000 per year. 5.0% is not so impressive profit but the safety of your fund and less hassles is guaranteed by our government. Other than that, for every Php10,000 Bond held, an eligible bondholder is entitled to one raffle number. Every year, a minimum of two (2) units of House and Lot packages or Lots worth Php1 Million each will be raffled off.

To invest, you must have:

• Accomplished Application to Purchase Pag-IBIG Housing Bond

• TIN and 2 valid IDs ( bearing photo and signature)

• Savings account with either DBP or LBP

• Manager’s check

Visit the Treasury Department of Pag-IBIG to make your investment.

• Pag-IBIG Fund Corporate Headquarters

• Treasury Department

• 4/F Atrium Building, Makati Avenue, Makati City

• Tel.: (632) 811-4340 / 811-4260 / 811-4380

The proof of ownership is the Bond certificate issued by the DBP Trust Services to you. As of now, I have no investment yet on Bonds. But sooner I really will, I’m not after for the 5.0% interest exactly but to the semi-annual raffles of “house and lot” worth Php1M. And even I won’t lucky won this raffle, still no big deal since our fund got earnings every year and not to mention the assistance we contribute to our government to construct low cost housing for our fellow Filipinos.

In fact, I'm living in a townhouse under Pag-IBIG loan.

Monday, March 29, 2010

MUTUAL FUNDS : TOP THINGS TO KNOW

1. What exactly is a mutual fund?

A mutual fund pools money from hundreds and thousands of investors to construct a portfolio of stocks, bonds, real estate, or other securities, according to its charter. Each investor in the fund gets a slice of the total pie.

2. Mutual funds make it easy to diversify.

Most funds require only moderate minimum investments, from a few hundred to a few thousand dollars, enabling investors to construct a diversified portfolio much more cheaply than they could on their own.

3. There are many kinds of stock funds.

The number of categories is dizzying. Some examples: growth funds, which buy shares of burgeoning companies; sector funds, which buy shares of companies in a particular sector, such as technology or health care; and index funds, which buy shares of every stock in a particular index, such as the Philippine Stock Exchange.

4. Bond funds come in many different flavors too.

There are bond funds for every taste. If you want safe investments, consider government bond funds; if you're willing to gamble on high-risk investments, try high-yield bond funds, also known as junk bond funds; and if you want to keep down your tax bill, try municipal bond funds.

5. Returns aren't everything - also consider the risk taken to achieve those returns.

Before buying a fund, look at how risky its investments are. Can you tolerate big market swings for a shot at higher returns? If not, stick with low-risk funds. To assess risk level, check these three factors: the fund's biggest quarterly loss, which will help you brace for the worst; its beta, which measures a fund's volatility against the PSE; and the standard deviation, which shows how much a fund bounces around its average returns.

6. Low expenses are crucial.

In order to cover their expenses - and to make a profit - funds charge a percentage of total assets. At no more than a few percentage points a year, expenses may not sound substantial, but they create a serious drag on performance over time.

7. Taxes take a big bite out of performance.

Even if you don't sell your fund shares, you could still end up stuck with a big tax bite. If a fund owns dividend-paying stocks, or if a fund manager sells some big winners, shareholders will owe their share. Investors are often surprised to learn they owe taxes - both for dividends and for capital gains - even for funds that have declined in value. Tax-efficient funds avoid rapid trading (and high short-term capital gains taxes) and match winning trades with losing trades.

8. Don't chase winners.

Funds that rank very highly over one period rarely finish on top in later ones. When choosing a fund, look for consistent long-term results.

9. Index funds should be a core component of your portfolio.

Index funds track the performance of market benchmarks. Such "passive" funds offer a number of advantages over "active" funds: Index funds tend to charge lower expenses and be more tax efficient, and there's no risk the fund manager will make sudden changes that throw off your portfolio's allocation.

10. Don't be too quick to dump a fund.

Any fund can - and probably will - have an off year. Though you may be tempted to sell a losing fund, first check to see whether it has trailed comparable funds for more than two years. If it hasn't, sit tight. But if earnings have been consistently below par, it may be time to move on.

Saturday, March 27, 2010

MUTUAL FUNDS : 2009 PERFORMANCE REPORT

Mutual funds in the Philippines ended the year 2009 on a high note, with all but one fund registering a positive return.

The funds reversed the losses incurred in 2008 as markets turned optimistic. Two funds, one equity (Philequity Fund) and one balanced (ALFM Growth Fund) even managed to beat the 63% return of the Philippine Stock Exchange index in 2009.

For the entire year, equity funds earned an average of 46.7%. This means an investment placed at the start of the year earned almost half of the total money invested.

Balanced funds trail closely, ending the year with an average return of 35.6%.

Peso bond funds produced an average return of 5.38%, while money market funds increased value on average by 1.36%.

Summarized below is the full-year performance of Philippine mutual funds, side by side with their return and rank during the preceding year.

PERFORMANCE OF MUTUAL FUNDS IN THE PHILIPPINES

For the Years Ended 2009 and 2008

Other Sources or References

• www.icap.com.ph – official website of the Investment Company Association of the Philippines (ICAP), the organization of mutual fund companies in the country.

• www.sec.gov.ph – official website of the Securities and Exchange Commission (SEC), the regulatory body for Philippine mutual fund companies.

The funds reversed the losses incurred in 2008 as markets turned optimistic. Two funds, one equity (Philequity Fund) and one balanced (ALFM Growth Fund) even managed to beat the 63% return of the Philippine Stock Exchange index in 2009.

For the entire year, equity funds earned an average of 46.7%. This means an investment placed at the start of the year earned almost half of the total money invested.

Balanced funds trail closely, ending the year with an average return of 35.6%.

Peso bond funds produced an average return of 5.38%, while money market funds increased value on average by 1.36%.

Summarized below is the full-year performance of Philippine mutual funds, side by side with their return and rank during the preceding year.

PERFORMANCE OF MUTUAL FUNDS IN THE PHILIPPINES

For the Years Ended 2009 and 2008

Other Sources or References

• www.icap.com.ph – official website of the Investment Company Association of the Philippines (ICAP), the organization of mutual fund companies in the country.

• www.sec.gov.ph – official website of the Securities and Exchange Commission (SEC), the regulatory body for Philippine mutual fund companies.

MUTUAL FUNDS : HOW TO COMPUTE YOUR EARNINGS

I've been holding my back-up investment at Sun Life Prosperity Phil. Equity Fund, Inc. (Mutual Fund) for a year now, and for 2009 it geared at-least 43.52% yields. When I discussed with it to my fellow investors... amazingly, lot of them are still at a loss regarding how their income from this investment is computed. We’ll try to simplify how it’s being done in this discussion.

Step 1: Determine how many shares you own

When you invest in mutual funds, you are actually buying “shares” of the mutual fund company. (See Introduction to Mutual Funds) The price you pay is the NAVPS or the Net Asset Value per Share, a figure that changes every day since it represents the market values of the investment assets the mutual fund company owns.

Let’s assume you want to invest P100,000. When you checked with the mutual fund, the NAVPS price is P1.75. The number of shares you will then get is:

• P100,000 divided by P1.75 = 57,142 shares

Your total fund value that day is:

• 57,142 shares x P1.75 NAVPS = P99,998.50

Since you paid P100,000 but the amount of the shares you bought is only P99,998.50, the company would actually return P1.50 to you.

For simplicity purposes, we did not consider any fees or sales loads charged by the fund. Do note, though, that most funds will charge a fee either upon investment (entry fee) or when redeeming your mutual fund shares (exit fee). We’ll defer computations including fees in a succeeding article.

Step 2: Determine the current NAVPS

At any day, you can compute the value of your mutual fund investment. The only two things relevant to you are:

1. Number of shares you own

2. NAVPS price on that day

Let’s assume that at the end of 1 year, the NAVPS of your mutual fund is P2.50. Your profit is simply the difference between the current NAVPS and the NAVPS when you bought your shares. Multiply this with the number of shares you own and you’ll get the amount of your profit.

Mathematically:

• Current NAVPS = P2.50

• Original NAVPS = P1.75

• Difference in NAVPS prices = P2.50 – P1.75 = P0.75

• Number of Shares Owned = 57,142

• Profit = P0.75 x 57,142 = P42,856.50

This same amount can also be computed by comparing the current total fund value and initial fund value.:

• Beginning fund value = 57,142 shares x P1.75 NAVPS = P99,998.50

• Current fund value = 57,142 shares x P2.50 NAVPS = P142,855.00

• Difference in fund values = Profit = P42,856.50

One major point to remember, though. This profit is still “paper profit” or “unrealized income.” That’s because you have not redeemed the shares yet. Any day afterwards, the NAVPS will still change which means your fund value and profit will also change.

We’ll show this in the next example.

Step 3: Calculate actual profit at time of redemption

Let’s assume you wanted to encash and redeem your shares at the end of the 2nd year. Before we proceed, you need to know that the fund value and NAVPS price at the end of Year 1 are now irrelevant. Whatever “profit” you gained before was not realized since you did not redeem the shares.

Assume that at the end of Year 2, the NAVPS price is P2.00. As in Step 2, we can compute the profit by comparing the current and original NAVPS:

• Current NAVPS = P2.00

• Original NAVPS = P1.75

• Difference in NAVPS prices = P2.00 – P1.75 = P0.25

• Number of Shares Owned = 57,142

• Profit = P0.25 x 57,142 = P14,285.50

At the end of Year 2, your total investment earned P14,285.50. If you redeemed all 57,142 shares, you can now actually earn and get P14,285.50 cash as profit.

The total money you would get from the mutual fund is this profit plus the original investment (P14,285.50 + P99,998.50), which can also be computed this way:

• Current NAVPS = P2.00

• Number of Shares Owned = 57,142

• Total Fund Value = P2.00 x 57,142 = P114,284.00

Again, be reminded that this computation does not consider any fees charged by the fund. Your fund value will be reduced by those fees.

In any case, I hope this gives you an idea how to compute your mutual fund income.

Sources or References

• www.icap.com.ph – official website of the Investment Company Association of the Philippines (ICAP), the organization of mutual fund companies in the country.

• www.sec.gov.ph – official website of the Securities and Exchange Commission (SEC), the regulatory body for Philippine mutual fund companies.

Friday, March 26, 2010

MUTUAL FUNDS : HOW IT WORKS AND LIST OF COMPANIES IN THE PHILIPPINES

A mutual fund is a company that pools investors' money to make multiple types of investments, known as the portfolio. Stocks, bonds, and money market funds are all examples of the types of investments that may make up a mutual fund.

The mutual fund is managed by a professional investment manager who buys and sells securities for the most effective growth of the fund. As a mutual fund investor, you become a "shareholder" of the mutual fund company. When there are profits you will earn dividends. When there are losses, your shares will decrease in value. The value of a share of the mutual fund, called the Net Asset Value (NAV), is calculated daily based on the fund’s total value divided by the total number of outstanding shares.

Mutual funds are, by definition, diversified, meaning they are made up a lot of different investments. That tends to lower your risk (avoiding the old "all of your eggs in one basket" problem).

Because someone else manages them, you don't have to worry about diversifying individual investments yourself or doing your own record keeping. That makes it easier to just buy them and forget about them. That's not always the best strategy, however -- your money is in someone else's hands, after all.

Since the fund manager's compensation is based on how well the fund performs, you can be assured they will work diligently to make sure the fund performs well. Managing their fund is their full-time job!

Mutual funds can be open-ended or closed-ended. But many people consider all mutual funds to be open-ended, while putting closed-ended funds in another category.

"Open-ended" means that shares are issued in the fund (or sold back to the fund) whenever anyone wants them. With closed-ended funds, only a certain number of shares can be issued for a particular fund, and they can only be sold back to the fund when the fund itself terminates. (You can sell closed-ended funds to other investors on the secondary market, though.)

Load refers to the sales charges added to a mutual fund when you purchase it. The load charge goes to the fund salesperson as a commission and payment for their research services. Load charges can be up to 8.5 percent of the selling price and can be figured in as a front-end load (meaning you pay it when you buy the mutual fund) or a back-end load (meaning you pay when you sell the mutual fund).

Many mutual funds are no-load funds. Yes, that means there is no sales fee charged and the fund is direct-marketed so you can buy it without the help of a salesperson. With the wealth of information on the Internet today, it is certainly easier to make smart choices yourself to save money.

In addition to no-load funds, there are also funds that charge up to 3.5 percent as a sales fee. These are called low-load funds and can still be a good deal.

Mutual funds fall into three categories:

• Equity funds are made up of investments of only common stock. These can be riskier (and earn more money) than other types.

• Fixed-income funds are made up of government and corporate securities that provide a fixed return and are usually low risk.

• Balanced funds combine both stocks and bonds in the investment pool and offer a moderate to low risk.

While low risk may sound good, it is also accompanied by lower rates of return-meaning you risk less, but your investment won't earn as much. You have to decide how much risk you're willing to take on before you invest your money.

If you have invested in a college savings fund or a 401k account, chances are good that already own a few mutual funds. Mutual funds are great for long-term investments like these. You can also buy mutual funds directly from a mutual fund company.

Most of these offer no-load funds (or sometimes low-load funds). You can find lists of mutual fund companies on the Internet and purchase shares by simply filling out an application and mailing a check. Once you are a shareholder, you will receive statements telling you how the fund is doing as well as how much your own investment is growing. You can also set up monthly bank transfers to automatically buy more shares every month.

Choosing which mutual funds to invest in ultimately depends on the investor’s growth goal and risk tolerance. If the purpose is capital growth, equity funds are the way to go. Bond funds are chosen, on the other hand, if the investor prefers capital preservation over risky capital growth. For those who want medium risk and medium growth, balanced funds are the best option. Money market funds are for those who wish to earn a conservative amount of return in the short-term.

Remember to do your research and select a mutual fund that fits the level of risk you are willing to take with your hard-earned cash. Then just sit back and hope for the best!

List of Mutual Fund companies in the Philippines

Stock Funds

• ATR- Kim Eng Equity Opportunity Fund – www.mutualfund.com.ph

• DWS Deutsche Philippine Equity Fund, Inc.

• First Metro Save and Learn Equity Fund – www.fami.com.ph

• Philam Strategic Growth Fund, Inc. – www.philamfunds.com

• Philequity Fund, Inc. – www.philequity.net

• Philequity PSE Index Fund Inc.

• Sun Life Prosperity Phil. Equity Fund, Inc. – www.sunlifefunds.com

• United Fund, Inc.

Balanced Funds

• ALFM Growth Fund, Inc.

• First Galleon Family Fund, Inc.

• First Metro Save and Learn Balanced Fund Inc.

• GSIS Kinabukasan Fund

• MFCP Kabuhayan Fund – www.mutualfund.com.ph

• Optima Balanced Fund, Inc.

• Philam Fund, Inc. – www.philamfunds.com

• Sun Life Prosperity Balanced Fund, Inc. – www.sunlifefunds.com

• Sun Life Prosperity Dollar Advantage Fund, Inc. – www.sunlifefunds.com

Bond Funds

• AIG Global Bond Fund Phils., Inc.

• ALFM Dollar Bond Fund, Inc.

• ALFM Euro Bond Fund, Inc.

• ALFM Peso Bond Fund, Inc.

• Cocolife Fixed Income Fund, Inc.

• DWS Deutsche Philippine Fixed Income

• Ekklesia Mutual Fund Inc.

• First Metro Save and Learn Fixed Income

• Grepalife Dollar Bond Fund (USD$) – www.grepafunds.com

• Grepalife Fixed Income Fund, Inc. – www.grepafunds.com

• MAA Privilege Dollar Fixed Income Fund, Inc. – www.maa.com.ph

• MAA Privilege Euro Fixed Income Fund, Inc. – www.mutualife.com.ph

• Philam Bond Fund, Inc. – www.philamfunds.com

• Philam Dollar Bond Fund, Inc. – www.philamfunds.com

• Philam Managed Income Fund

• Philequity Dollar Income Fund Inc.

• Philequity Peso Bond Fund

• Prudential Fixed Income Fund Inc.

• Sun Life Prosperity Bond Fund, Inc. – www.sunlifefunds.com

• Sun Life Prosperity Dollar Abundance fund – www.sunlifefunds.com

• Sun Life Prosperity GS Fund – www.sunlifefunds.com

Money Market Funds

• ATR Kimeng Money Market Fund, Inc.

• Sun Life Prosperity Money Market Fund, Inc. – www.sunlifefunds.com

The mutual fund is managed by a professional investment manager who buys and sells securities for the most effective growth of the fund. As a mutual fund investor, you become a "shareholder" of the mutual fund company. When there are profits you will earn dividends. When there are losses, your shares will decrease in value. The value of a share of the mutual fund, called the Net Asset Value (NAV), is calculated daily based on the fund’s total value divided by the total number of outstanding shares.

Mutual funds are, by definition, diversified, meaning they are made up a lot of different investments. That tends to lower your risk (avoiding the old "all of your eggs in one basket" problem).

Because someone else manages them, you don't have to worry about diversifying individual investments yourself or doing your own record keeping. That makes it easier to just buy them and forget about them. That's not always the best strategy, however -- your money is in someone else's hands, after all.

Since the fund manager's compensation is based on how well the fund performs, you can be assured they will work diligently to make sure the fund performs well. Managing their fund is their full-time job!

Mutual funds can be open-ended or closed-ended. But many people consider all mutual funds to be open-ended, while putting closed-ended funds in another category.

"Open-ended" means that shares are issued in the fund (or sold back to the fund) whenever anyone wants them. With closed-ended funds, only a certain number of shares can be issued for a particular fund, and they can only be sold back to the fund when the fund itself terminates. (You can sell closed-ended funds to other investors on the secondary market, though.)

Load refers to the sales charges added to a mutual fund when you purchase it. The load charge goes to the fund salesperson as a commission and payment for their research services. Load charges can be up to 8.5 percent of the selling price and can be figured in as a front-end load (meaning you pay it when you buy the mutual fund) or a back-end load (meaning you pay when you sell the mutual fund).

Many mutual funds are no-load funds. Yes, that means there is no sales fee charged and the fund is direct-marketed so you can buy it without the help of a salesperson. With the wealth of information on the Internet today, it is certainly easier to make smart choices yourself to save money.

In addition to no-load funds, there are also funds that charge up to 3.5 percent as a sales fee. These are called low-load funds and can still be a good deal.

Mutual funds fall into three categories:

• Equity funds are made up of investments of only common stock. These can be riskier (and earn more money) than other types.

• Fixed-income funds are made up of government and corporate securities that provide a fixed return and are usually low risk.

• Balanced funds combine both stocks and bonds in the investment pool and offer a moderate to low risk.

While low risk may sound good, it is also accompanied by lower rates of return-meaning you risk less, but your investment won't earn as much. You have to decide how much risk you're willing to take on before you invest your money.

If you have invested in a college savings fund or a 401k account, chances are good that already own a few mutual funds. Mutual funds are great for long-term investments like these. You can also buy mutual funds directly from a mutual fund company.

Most of these offer no-load funds (or sometimes low-load funds). You can find lists of mutual fund companies on the Internet and purchase shares by simply filling out an application and mailing a check. Once you are a shareholder, you will receive statements telling you how the fund is doing as well as how much your own investment is growing. You can also set up monthly bank transfers to automatically buy more shares every month.

Choosing which mutual funds to invest in ultimately depends on the investor’s growth goal and risk tolerance. If the purpose is capital growth, equity funds are the way to go. Bond funds are chosen, on the other hand, if the investor prefers capital preservation over risky capital growth. For those who want medium risk and medium growth, balanced funds are the best option. Money market funds are for those who wish to earn a conservative amount of return in the short-term.

Remember to do your research and select a mutual fund that fits the level of risk you are willing to take with your hard-earned cash. Then just sit back and hope for the best!

List of Mutual Fund companies in the Philippines

Stock Funds

• ATR- Kim Eng Equity Opportunity Fund – www.mutualfund.com.ph

• DWS Deutsche Philippine Equity Fund, Inc.

• First Metro Save and Learn Equity Fund – www.fami.com.ph

• Philam Strategic Growth Fund, Inc. – www.philamfunds.com

• Philequity Fund, Inc. – www.philequity.net

• Philequity PSE Index Fund Inc.

• Sun Life Prosperity Phil. Equity Fund, Inc. – www.sunlifefunds.com

• United Fund, Inc.

Balanced Funds

• ALFM Growth Fund, Inc.

• First Galleon Family Fund, Inc.

• First Metro Save and Learn Balanced Fund Inc.

• GSIS Kinabukasan Fund

• MFCP Kabuhayan Fund – www.mutualfund.com.ph

• Optima Balanced Fund, Inc.

• Philam Fund, Inc. – www.philamfunds.com

• Sun Life Prosperity Balanced Fund, Inc. – www.sunlifefunds.com

• Sun Life Prosperity Dollar Advantage Fund, Inc. – www.sunlifefunds.com

Bond Funds

• AIG Global Bond Fund Phils., Inc.

• ALFM Dollar Bond Fund, Inc.

• ALFM Euro Bond Fund, Inc.

• ALFM Peso Bond Fund, Inc.

• Cocolife Fixed Income Fund, Inc.

• DWS Deutsche Philippine Fixed Income

• Ekklesia Mutual Fund Inc.

• First Metro Save and Learn Fixed Income

• Grepalife Dollar Bond Fund (USD$) – www.grepafunds.com

• Grepalife Fixed Income Fund, Inc. – www.grepafunds.com

• MAA Privilege Dollar Fixed Income Fund, Inc. – www.maa.com.ph

• MAA Privilege Euro Fixed Income Fund, Inc. – www.mutualife.com.ph

• Philam Bond Fund, Inc. – www.philamfunds.com

• Philam Dollar Bond Fund, Inc. – www.philamfunds.com

• Philam Managed Income Fund

• Philequity Dollar Income Fund Inc.

• Philequity Peso Bond Fund

• Prudential Fixed Income Fund Inc.

• Sun Life Prosperity Bond Fund, Inc. – www.sunlifefunds.com

• Sun Life Prosperity Dollar Abundance fund – www.sunlifefunds.com

• Sun Life Prosperity GS Fund – www.sunlifefunds.com

Money Market Funds

• ATR Kimeng Money Market Fund, Inc.

• Sun Life Prosperity Money Market Fund, Inc. – www.sunlifefunds.com

Thursday, March 25, 2010

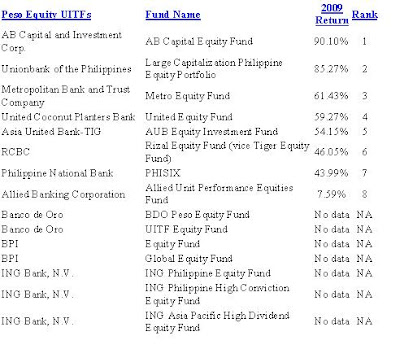

BANKS: 2009 PERFORMANCE OF "UNIT INVESTMENT TRUST FUND" (UITF)

Unit Investment Trust Funds or UITFs in the Philippines ended the year 2009 also on a high note just like the mutual funds.

Equity UITFs performed particularly strong last year, with two funds easily surpassing the 63% return of the Philippine Stock Exchange index (PSEi). AB Capital’s Equity Fund and Unionbank of the Philippines‘ Large Capitalization Equity Portfolio earned a full-year return of 90.10% and 85.27%, respectively — which means if you placed an investment in either fund at the start of the year, your money would have almost doubled by the end of 2009.

Below is a summary of the full-year return of each UITF.

The Dollar-denominated Unit Investment Trust Funds or UITFs also performed well in 2009, just like their Peso UITF counterparts.

In addition, most of the funds reversed and surpassed the 2.45% depreciation of the US Dollar versus the Peso last year, which could have reduced the value of the dollar investment.

Below is a summary of the full-year return of each dollar-denominated UITF.

Equity UITFs performed particularly strong last year, with two funds easily surpassing the 63% return of the Philippine Stock Exchange index (PSEi). AB Capital’s Equity Fund and Unionbank of the Philippines‘ Large Capitalization Equity Portfolio earned a full-year return of 90.10% and 85.27%, respectively — which means if you placed an investment in either fund at the start of the year, your money would have almost doubled by the end of 2009.

Below is a summary of the full-year return of each UITF.

PESO - PERFORMANCE OF UNIT INVESTMENT

TRUST FUNDS (UITF) IN THE PHILIPPINES

For the Year Ended 2009

The Dollar-denominated Unit Investment Trust Funds or UITFs also performed well in 2009, just like their Peso UITF counterparts.

In addition, most of the funds reversed and surpassed the 2.45% depreciation of the US Dollar versus the Peso last year, which could have reduced the value of the dollar investment.

Below is a summary of the full-year return of each dollar-denominated UITF.

DOLLAR - PERFORMANCE OF UNIT INVESTMENT

TRUST FUNDS (UITF) IN THE PHILIPPINES

For the Year Ended 2009

The performance of each individual UITF can also be viewed at the Trust Officers Association of the Philippines (TOAP) site http://www.uitf.com.ph.

BANKS : HOW TO CALCULATE YOUR INTEREST EARNINGS...

The term interest seems to baffle some. As consumers, we're familiar with paying interest on a loan or credit card. But did you know that you can put your money to work? Banks will pay you to keep your funds on deposit. Their payment to you is known as interest and is indeed income. Follow this simple steps to calculate your interest income, and you could be laughing all the way to the bank.

Let set an example, if you have Php50,000.00 and want to invest on Time Deposit. The bank will offer you their TD program with respected interest. From the below chart (example), your money can avail 2.5% in 364 days or 2.0% in 35 days.

Interest = Principal x Rate x Time.

Principal refers to the initial amount of your deposit or investment. Rate is the percentage used to calculate the monetary return on your investment. Time is simply how long you hold the investment before withdrawing it from the bank. Generally, instruments that pay a higher yield require a higher principle.

Multiply your principal by your interest rate, then the days of holding.

50,000.00 x 2.0% = Php1,000.00

* 1,000.00 x 35/365 = Php95.89 interest on 35 days

50,000.00 x 2.5% = Php1,250.00

* 1,250.00 x 365/365 = Php1,250.00 interest on 365 days

If your interest compounded monthly/yearly, add your result to your balance, and repeat the previous step.

Let set an example, if you have Php50,000.00 and want to invest on Time Deposit. The bank will offer you their TD program with respected interest. From the below chart (example), your money can avail 2.5% in 364 days or 2.0% in 35 days.

Interest = Principal x Rate x Time.

Principal refers to the initial amount of your deposit or investment. Rate is the percentage used to calculate the monetary return on your investment. Time is simply how long you hold the investment before withdrawing it from the bank. Generally, instruments that pay a higher yield require a higher principle.

Multiply your principal by your interest rate, then the days of holding.

50,000.00 x 2.0% = Php1,000.00

* 1,000.00 x 35/365 = Php95.89 interest on 35 days

50,000.00 x 2.5% = Php1,250.00

* 1,250.00 x 365/365 = Php1,250.00 interest on 365 days

If your interest compounded monthly/yearly, add your result to your balance, and repeat the previous step.

Tuesday, March 16, 2010

BANKS: TIME DEPOSIT (TD)

A very common investment vehicle for an ordinary Filipino like me/us, to place safely your hard earned money, same as savings account or Certificate of Deposit (CD) held for a fixed-term with the understanding that the depositor can only withdraw by giving written notice.

Quite safer since the Philippine Deposit Insurance Corporation (PDIC) insures deposits up to P500,000. Consider investing in a time deposit for higher interest. The secret to earning in a time deposit is to hold it for a long term at an interest rate higher than the inflation rate. You can also have investment in foreign currency to take advantage of higher rates depending on the market. But to the other side, the interest gained here is minimal compared to other investment vehicles.

Time deposits offer a slightly higher yield than T-Bills because of the slightly higher default risk for a bank but, overall, the likelihood that a large bank will go broke is pretty slim. Of course, the amount of interest you earn depends on a number of other factors such as the current interest rate environment, how much money you invest, the length of time and the particular bank you choose. While nearly every bank offers TDs, the rates are rarely competitive, so it's important to shop around.

The main advantage of TDs is their relative safety and the ability to know your return ahead of time. You'll generally earn more than in a savings account, and you won't be at the mercy of the stock market. But despite the benefits, there are two main disadvantages to TDs. First of all, the returns are paltry compared to many other investments. Furthermore, your money is tied up for the length of the TD and you won't be able to get it out without paying a harsh penalty.

Below are my favorite Banks that offered Personal-Regular Peso Time Deposit rate;

* BPI Bank-

* Planters Development Bank

* Allied Bank

* PS Bank

Other banks didn’t post there rates online and preferred to be call on telephone in any branch near you.

Quite safer since the Philippine Deposit Insurance Corporation (PDIC) insures deposits up to P500,000. Consider investing in a time deposit for higher interest. The secret to earning in a time deposit is to hold it for a long term at an interest rate higher than the inflation rate. You can also have investment in foreign currency to take advantage of higher rates depending on the market. But to the other side, the interest gained here is minimal compared to other investment vehicles.

Time deposits offer a slightly higher yield than T-Bills because of the slightly higher default risk for a bank but, overall, the likelihood that a large bank will go broke is pretty slim. Of course, the amount of interest you earn depends on a number of other factors such as the current interest rate environment, how much money you invest, the length of time and the particular bank you choose. While nearly every bank offers TDs, the rates are rarely competitive, so it's important to shop around.

The main advantage of TDs is their relative safety and the ability to know your return ahead of time. You'll generally earn more than in a savings account, and you won't be at the mercy of the stock market. But despite the benefits, there are two main disadvantages to TDs. First of all, the returns are paltry compared to many other investments. Furthermore, your money is tied up for the length of the TD and you won't be able to get it out without paying a harsh penalty.

Below are my favorite Banks that offered Personal-Regular Peso Time Deposit rate;

* BPI Bank-

* Planters Development Bank

* Allied Bank

* PS Bank

Other banks didn’t post there rates online and preferred to be call on telephone in any branch near you.

Monday, March 15, 2010

BANKS: TRUST FUND INVESTMENT

Unit investment trust funds allow small scale investors to participate in large fund investing that is otherwise inaccessible to them.

Unit investment trust funds (UITFs) are the sophisticated form of pooled fund (paluwagan), the investment that doubles as a savings plan many Filipinos are familiar with. UITF is a collective investment scheme that pools the investments of small investors into a larger fund under professional management. It is able to access more superior investment opportunities not normally available to individual retail investors.

This kind of trust fund comes with a number of advantages. One is the low minimum investment required, which starts at P10,000. Another is that one need not be a finance expert to make an investment. Because the money is pooled, investors diversify their portfolio and minimize their risks. The fund determines the best way to park the money, whether it is in commercial paper, bonds, or equities.

But please be reminded that Unit Investment Trust Funds (UITFs) are not deposit products and are not covered by the Philippine Deposit Insurance Corporation. Due to daily marking-to-market of investments, the price or the net asset value per unit of the UITFs may fluctuate depending on the prevailing market conditions. Historical returns of the Funds are for indication purposes only and are not guarantee of future results, any income or loss that may result from the performance of the Funds shall be for the account of the participant.

The type of unit investment trust funds (UITFs) depends on the investments they make. Here are some UITFs in the market today:

1. Money market securities UITFs. These are low risk, high liquidity investments.

2. Bond UITFs entail more risks but promise higher returns in the long term.

To see price history, you can visit directly to the bank website under investment category. Else, check from this site http://www.uitf.com.ph...

Unit investment trust funds (UITFs) are the sophisticated form of pooled fund (paluwagan), the investment that doubles as a savings plan many Filipinos are familiar with. UITF is a collective investment scheme that pools the investments of small investors into a larger fund under professional management. It is able to access more superior investment opportunities not normally available to individual retail investors.

This kind of trust fund comes with a number of advantages. One is the low minimum investment required, which starts at P10,000. Another is that one need not be a finance expert to make an investment. Because the money is pooled, investors diversify their portfolio and minimize their risks. The fund determines the best way to park the money, whether it is in commercial paper, bonds, or equities.

But please be reminded that Unit Investment Trust Funds (UITFs) are not deposit products and are not covered by the Philippine Deposit Insurance Corporation. Due to daily marking-to-market of investments, the price or the net asset value per unit of the UITFs may fluctuate depending on the prevailing market conditions. Historical returns of the Funds are for indication purposes only and are not guarantee of future results, any income or loss that may result from the performance of the Funds shall be for the account of the participant.

The type of unit investment trust funds (UITFs) depends on the investments they make. Here are some UITFs in the market today:

1. Money market securities UITFs. These are low risk, high liquidity investments.

2. Bond UITFs entail more risks but promise higher returns in the long term.

To see price history, you can visit directly to the bank website under investment category. Else, check from this site http://www.uitf.com.ph...

Friday, March 12, 2010

BUSINESS : FRANCHISING

Choosing a right franchise is very important that would also fit on your lifestyle.As much as possible, choose a concept you really like or have a passion for. This would make it easier for you to succeed because if you enjoy running a business, you really wouldn't mind spending your time taking care of it.

Another thing: a lot of people have a misconception that once you open a franchise store, the money will start rolling in as a matter of course. This isn't the case at all. You as a franchisee must really learn how to run the business; you need to familiarize yourself with the various nuances of its operations.

It's highly advisable to talk to other franchisees before making your choice of franchise. What is their relationship with the franchiser like? Are they getting the right amount of support from the mother company? Are they satisfied with the business model? Aside from meeting with franchise personnel of the company, be sure to get to know those people you will be working most closely with as you build your business. The President of the company is most likely an impressive person, but that's not who will be answering your call when you have a problem. Find out who will be providing the operational support and training directly to you and form an opinion about their competence. Make sure that any remaining questions or issues you may have are addressed at this meeting.

Also, you need to read franchise agreements thoroughly before signing them or handing them to a lawyer. The franchise agreement spells out the details of the relationship during the period of the contract. Reading and understanding the various expectations and commitments spelled out in the contract will help you a lot because ultimately, it won't be your lawyer but you yourself who must live up to your part of the deal.

If everything is not cle, don't attempt to go through it by yourself. Even with your business acumen, there are bound to be a few things you might overlook which may cost you in the long run. There are people who can guide you through the franchising process and help you review and discuss unfamiliar topics or material. Lot of expert out-there, don't hesitate to consult first.

Advantages of Franchises

* One of the major advantages of franchises is the established name recognition it provide to the business. If a small business is associated and linked with a big-business then there is a high probability that the small business would propel due to the firm backup and support of an established big business. Running a small business under the franchisor's name and organization is very beneficial for businesses that can't afford much finance and capital investment for their own business.

* Another major advantage of franchises is that when a business is associated with a franchisor then the big-business themselves help in corporate marketing of the small industry or business they are providing support for. Having the interest of big-budget industries in a low-budget business is a very effective marketing tactic and these franchises policy ensures the proper marketing of a small business.

* An advantage of franchises is the bulk purchasing power it gives to small business and industries. Since most of the initial financial burden is provided to the business once it's franchised by the franchiser therefore this enables the business to buy equipments, products and other necessities to run the business with ease and without worrying about the financial investment.

* A major advantage of franchise is the training and management facilities the franchisor provides to the business. A company which provide capital and investment to any small business have vested interest in the success of the small business. Therefore the companies that provide franchise ensure that the business in which the money is being invested is run and manage properly. The big-businesses and industry provides all the necessary training to the small business staff and provide additional resources and decision-making capabilities to a small business.

Disadvantages of Franchises

* Disadvantage of franchises includes the indulgence of a big-business into a small business. The creative control that a small business owner have is often hinder when franchising in done. Any decision which is to be made is to be consulted and approved by the franchisors. This limits the authoritative control of the small business owner to a great extent.

* Another disadvantage of franchises is reaching a general agreement on terms and conditions. There are several occasions when the term and conditions imposed by the investors and franchisors are biased and getting a firm deal with the companies safe-guarding the interest of both parties is a complex task.

* A disadvantage of franchises is that the much time is required while selecting a franchise. A complete and through research is required to select the right franchise and to determine whether it would work for the business or not.

* Another disadvantage of franchises is that this is a complex procedure and there are numerous instant during the business when heated discuTession and disputes occurs between the small business and franchisor.

This site will help you for list of latest available franchise in the Philippines;

Phils. Franchise Association - http://www.pfa.org.ph/

Unit 701, One Magnificent Mile, San Miguel Avenue, Ortigas Center, Pasig City

Tel: (02) 687-03 65 to 67

Association of Filipino Franchisers, Inc. (AFFI) - www.affi.com.ph/

Unit 3A, Classica I Condominium, 112 H.V. dela Costa St., Makati City

Tel: (02) 633-8547

Another thing: a lot of people have a misconception that once you open a franchise store, the money will start rolling in as a matter of course. This isn't the case at all. You as a franchisee must really learn how to run the business; you need to familiarize yourself with the various nuances of its operations.

It's highly advisable to talk to other franchisees before making your choice of franchise. What is their relationship with the franchiser like? Are they getting the right amount of support from the mother company? Are they satisfied with the business model? Aside from meeting with franchise personnel of the company, be sure to get to know those people you will be working most closely with as you build your business. The President of the company is most likely an impressive person, but that's not who will be answering your call when you have a problem. Find out who will be providing the operational support and training directly to you and form an opinion about their competence. Make sure that any remaining questions or issues you may have are addressed at this meeting.

Also, you need to read franchise agreements thoroughly before signing them or handing them to a lawyer. The franchise agreement spells out the details of the relationship during the period of the contract. Reading and understanding the various expectations and commitments spelled out in the contract will help you a lot because ultimately, it won't be your lawyer but you yourself who must live up to your part of the deal.

If everything is not cle, don't attempt to go through it by yourself. Even with your business acumen, there are bound to be a few things you might overlook which may cost you in the long run. There are people who can guide you through the franchising process and help you review and discuss unfamiliar topics or material. Lot of expert out-there, don't hesitate to consult first.

Advantages of Franchises

* One of the major advantages of franchises is the established name recognition it provide to the business. If a small business is associated and linked with a big-business then there is a high probability that the small business would propel due to the firm backup and support of an established big business. Running a small business under the franchisor's name and organization is very beneficial for businesses that can't afford much finance and capital investment for their own business.

* Another major advantage of franchises is that when a business is associated with a franchisor then the big-business themselves help in corporate marketing of the small industry or business they are providing support for. Having the interest of big-budget industries in a low-budget business is a very effective marketing tactic and these franchises policy ensures the proper marketing of a small business.

* An advantage of franchises is the bulk purchasing power it gives to small business and industries. Since most of the initial financial burden is provided to the business once it's franchised by the franchiser therefore this enables the business to buy equipments, products and other necessities to run the business with ease and without worrying about the financial investment.

* A major advantage of franchise is the training and management facilities the franchisor provides to the business. A company which provide capital and investment to any small business have vested interest in the success of the small business. Therefore the companies that provide franchise ensure that the business in which the money is being invested is run and manage properly. The big-businesses and industry provides all the necessary training to the small business staff and provide additional resources and decision-making capabilities to a small business.

Disadvantages of Franchises

* Disadvantage of franchises includes the indulgence of a big-business into a small business. The creative control that a small business owner have is often hinder when franchising in done. Any decision which is to be made is to be consulted and approved by the franchisors. This limits the authoritative control of the small business owner to a great extent.

* Another disadvantage of franchises is reaching a general agreement on terms and conditions. There are several occasions when the term and conditions imposed by the investors and franchisors are biased and getting a firm deal with the companies safe-guarding the interest of both parties is a complex task.

* A disadvantage of franchises is that the much time is required while selecting a franchise. A complete and through research is required to select the right franchise and to determine whether it would work for the business or not.

* Another disadvantage of franchises is that this is a complex procedure and there are numerous instant during the business when heated discuTession and disputes occurs between the small business and franchisor.

This site will help you for list of latest available franchise in the Philippines;

Phils. Franchise Association - http://www.pfa.org.ph/

Unit 701, One Magnificent Mile, San Miguel Avenue, Ortigas Center, Pasig City

Tel: (02) 687-03 65 to 67

Association of Filipino Franchisers, Inc. (AFFI) - www.affi.com.ph/

Unit 3A, Classica I Condominium, 112 H.V. dela Costa St., Makati City

Tel: (02) 633-8547

STOCKS INVESTMENT (Philippine Stock Exchange)

For a minimum of Php5K, you can buy stocks at PSE.

For a minimum of Php5K, you can buy stocks at PSE.WHAT ARE STOCKS? SECURITIES?

Stocks are shares of ownership in a corporation. When you become a stockholder or shareholder of a company, you become part-owner of that company. Securities, on the other hand, are proof of one's ownership or indebtedness in a company. Examples of securities are treasury bills and commercial papers, which are considered as short-term and are traded in the money market; and stocks and bonds, which are long-term and traded in the capital market. Securities are easily bought and sold in the stock market.

WHAT ARE THE TYPES OF SECURITIES THAT I CAN BUY IN THE STOCK MARKET?

Most of the issues listed in the PSE are common stocks. Other types of securities such as preferred stocks, warrants, PDRs and bonds are also traded.

1. Common Stocks - These are usually purchased for participation in the profits and control of ownership and management of the company. Holders of common stocks have voting rights. They are also entitled to an equal pro rata division of profits without preference or advantage over another stockholder. However, they have the last claim on dividends and are the last to collect in case of corporate liquidation.

2. Preferred Stocks - Its name is derived from preference given to the holders of these stocks over holders of common stocks. Holders of preferred stocks are entitled to receive dividends, to the extent agreed upon, before any dividends are paid to the holders of common stocks. However, preferred stocks usually have a specified limited rate of return or dividend and a specified limited redemption and liquidation price.

3. Warrants - A corporation can also raise additional capital by issuing warrants. A warrant, normally issued on a detachable basis, allows its holders the right, but not the obligation, to subscribe to new shares at a set price during a specified period of time. It is usually provided free of charge and traded separately in the securities market.

4. Philippine Deposit Receipts (PDRs) - A PDR is a security which grants the holder the right to the delivery or sale of the underlying share, and to certain other rights including additional PDR or adjustments to the terms or upon the occurrence of certain events in respect of rights issues, capital reorganizations, offers and analogous events or the distribution of cash in the event of a cash dividend on the shares. PDRs are evidences or statements nor certificates of ownership of a foreign/foreign-based corporation. For as long as the PDRs arenot exercised, the shares underlying the PDRs are and will continue to be registered in the name of and owned by and all rights pertaining to the shares shall be exercised by the issuer.

5. Small-Demominated Treasury Bonds (SDT-Bonds) - The SDT Bonds are long-term and relatively risk-free debt securities issued by the Bureau of Treasury (BTr) of the Republic of the Philippines. The bond is a certificate of indebtedness of the Republic of the Philippines to the owner of the SDT-Bonds.

WHERE CAN I BUY OR SELL SHARES OF STOCKS AND/OR BONDS?

In the Philippines, the only operating stock exchange is the Philippine Stock Exchange (PSE). Its main function is to facilitate the buying and selling of stocks and other securities through its accredited trading participants.

The PSE has two trading floors - PSE Centre in Ortigas, Pasig City and PSE Plaza in Ayala, Makati City - where trading participants trade daily - from 9:30 a.m. to 12:10 p.m. except Saturdays, Sundays, legal holidays and days when the Central Bank Clearing Office is closed.

HOW ARE SHARES AND SDT-BONDS BOUGHT OR SOLD?

If you wish to buy shares of stocks or SDT-Bonds, you must have a stockbroker who will do this for you. A stockbroker is a person or a corporation authorized and licensed by the Securities and Exchange Commission (SEC) and PSE to trade securities.

Investing Procedures:

1. Choose a stockbroker. The PSE has a complete list and information about all its trading participants who are authorized and qualified to trade either equity or debt securities for you. This list is also available on the Exchange's website and the PLDT directory's Government and Business listings yellow pages under the category of stock and bond brokers.

2. You shall be required to open an account and fill-out a Reference Card and to submit identification papers for verification. The stockbroker will then assign a trader or agent to assist you in either buying or selling any listed security. Discuss with the trader what stocks to buy or sell.

3. Give the order to your broker/trader, and then get the acknowledgement receipt.

4. For equity transactions: Deliver the Stock Certificate if you are selling or pay within the settlement date (3 days from date of transaction) if you are buying. Some brokers may require you to pay with post-dated checks upon ordering.

For SDT-Bonds transactions: Selling investors must open a RoSS account under his broker's sub-account and instruct his bank-underwriter to transfer the share to this account. Buying investors must also open an account with a BTr accredited bank and pay the appropriate amount of transaction to the settlement bank on the trade date.

5. You shall receive from your broker either the proceeds of sale your stocks (after 3 days for equities and on the date of trade for SDT-Bonds) or proof of ownership of stocks you bought (confirmation receipt and invoice). If you wish to have a physical certificate of the equities you bought, just give instructions to your broker and pay the required upliftment fee. Buyers of SDT-Bonds will only be given a confirmation slip in lieu of the bond certificates.

You can purchase shares of stock either through IPO (Initial Public Offering) or through the open market. Shares sold through IPOs are offered for the first time to the public by the company (primary market) whereby proceeds of the sale go directly to the company. Shares of listed or publicly traded companies are bought during trading (open market). These shares have since been transferred from one owner to another (secondary market) and proceeds of the sales do not go directly to the company but to the owners of the shares.

THE TRADING CYCLE

Equity trading is done by board lot or round lot system. The Board Lot Table determines the minimum number of shares one can purchase or sell at a specific price range. Therefore, the minimum amount needed to invest in the stock market varies and will depend on the market price of the security as well as its corresponding board lot. Prices of stocks move through a scale of minimum price fluctuations.

On the other hand, the minimum amount of SDT-Bonds that an investor can buy if PhP 5,000.00.

Board Lot Table

The following securities fees and taxes (subject to change) are levied on the investors:

Buying Transaction:

Mr. X wishes to buy a stock whose market price is P10.00 and with a par value of P1.00. Based on the Board Lot Table, the minimum number of shares he can buy at a regular transaction is 1,000 shares (a). In this case, the amount that he needs is about P10,000.00 plus charges. His required cash outflow will be as follows:

Selling Transaction:

Mr. Y wishes to sell a stock whose market price is P5.00 and with a par value of P1.00. Based on the Board Lot Table, the minimum number of shares he can sell at a regular transaction is 1,000 (b). In this case, the proceeds of the sale is about P5,000.00 less charges. His cash inflow will be as follows:

HOW CAN I PROFIT IN THE STOCK MARKET?

Investors can profit in the stock market thru any or a combination of the following;

Capital Gains - These are profits made due to an increase in the market price of a stock from the buying price.

Cash Dividend - A dividend given to shareholders in the form of cash. It is computed by multiplying the number of shares held by the cash dividend rate declared.

Stock Dividend - A dividend given to shareholders in the form of additional stocks. It is computed by multiplying the number of shares held by the percentage of the stock dividend declared.

Stock Rights - Stock rights offering is the option given to the present shareholders to buy additional shares of stock at a price lower than its market price.

IS THERE ANY RISK INVOLVED IN INVESTING?

Yes, since risk is always a part of any investment. And because stock investment is the most volatile, a better attitude would be to limit and manage your risk. A maximum level of gain or loss should be set and calculated decisions should be made when this level is reached.

DO I NEED TO KEEP TRACK OF MY INVESTMENT?

Yes! Having placed some amount in stocks, you should spend some time and effort in studying your investment. You should keep track of the stock price and follow closely the developments of the company. This way, you are able to foresee possible gains or losses that will guide you in making sound and wise investment decisions.

Daily quotations of stock prices can be obtained from your stockbroker or from all leading newspapers. You may also get information from our official website: www.pse.com.ph or from the PSE-Public Information and Assistance Center (PIAC) at telephone numbers 688-7602 to 03.

Below are the list of online stock-broker in the Philippines;

AB Capital Securities, Inc.

Website: www.abcapitalonline.com

Accord Capital Equities Corporation

Website: www.philstocks.ph

BPI Securities Corporation

Website: www.bpitrade.com

CitiSecurities, Inc.

Website: www.citiseconline.com

Diversified Securities, Inc.

Website: www.dfnn.com

F. Yap Securities, Inc.

Website: www.2tradeasia.com

First Metro Securities Brokerage Corporation

Website: www.firstmetrosec.com.ph

RCBC Securities, Inc.

Website: www.rcbcsec.com

Thursday, March 11, 2010

REAL ESTATE INVESTMENT

Secrets Revealed: Investing in foreclosures. Own your dream home or best real estate investments in auctions

So why foreclosures???

LOW CASH DOWN-PAYMENT:

I never knew that there were auctions that only required down payments as low as 5~10%! Anyway, having a low down payment requirement is really one of the advantages of buying foreclosed properties. I often hear people say that investing in real estate requires a lot of money. I beg to disagree! However, I do understand where these people are coming from as I too had the same thoughts until I found out that only low down payments are required when buying bank-foreclosed properties and this is often called leverage.

LONG PAYMENT TERMS:

I’m not really sure what the last sentence meant but what I do understand is that longer payment terms mean lower monthly amortizations which translates to higher positive cashflow. The last sentence could also mean that you will be paying amortizations based on the value of the real estate at the time of purchase (so you peg the price). At the end of the payment period, the value of the property has already appreciated and you can profit from the appreciation when you sell the property. Hedging basically means that you buy low now and peg the purchase price because you anticipate that the value of the property you bought will appreciate later.

LOW INTEREST:

8% interest rates are usually available only for the first year and this is often not a fixed rate. This means at the end of the year your loan may be subject to “repricing” or adjustments in case the market interest rates have changed. What happens if a new financial crisis happens(God forbid) and interest rates shoot up? Then the interest rate of your loan shoots up as well along with your monthly amortizations, which can lead to negative cashflow situations and even more foreclosures. This is the reason why I often advice that one should always make sure that their interest rates are fixed for the longest possible term. By the way, other lending institutions like Pag-IBIG may offer lower interest rates (6% for loans up to Php400,000 and 7% for loans over Php400,000 up to Php750,000). I suppose transferring a loan from a bank to Pag-IBIG would be a good option in such cases.

EASY CREDIT APPROVAL:

Some banks use a Contract-To-Sell (CTS) wherein the Title of the property is not yet transferred to the buyer until the purchase price is paid in full. In contrast, if a property was bought through a mortgage loan, the Title is already transferred to the buyer and the same Title is then mortgaged to the bank. Because of this, the latter may require more stringent requirements. But still, even if a bank or a lending institution will be using a CTS, they would still do a credit investigation like checking a buyer’s capacity to pay, etc.

GOOD TITLE:

Banks are supposed to do due diligence before they accept a property as collateral for a loan so this is very true. Nevertheless, one should always do his or her due diligence even if one is buying a foreclosed property from a bank because sometimes foreclosed properties are involved in pending court cases (like the red tag foreclosed properties from BPI-Buena Mano) and these are annotated on the Title as a lis pendens (pending case). Always do your due diligence. At the minimum, one should get certified true copies of the Title plus traceback from the registry of deeds, etc.

IMMEDIATE APPRECIATION:

I believe what they were trying to say was one can get immediate appreciation in the form of instant equity (Equity is the difference between a property’s current appraised value /market value and the loan principal balance) if you are able to buy a foreclosed property at a price below market value. This is the essence of the statement “You make money when you buy, not when you sell” as often said by Robert Kiyosaki, author of Rich Dad Poor Dad. Just make sure that you really are buying a property below market value by doing your own property valuation.

So why foreclosures???

LOW CASH DOWN-PAYMENT:

I never knew that there were auctions that only required down payments as low as 5~10%! Anyway, having a low down payment requirement is really one of the advantages of buying foreclosed properties. I often hear people say that investing in real estate requires a lot of money. I beg to disagree! However, I do understand where these people are coming from as I too had the same thoughts until I found out that only low down payments are required when buying bank-foreclosed properties and this is often called leverage.

LONG PAYMENT TERMS:

I’m not really sure what the last sentence meant but what I do understand is that longer payment terms mean lower monthly amortizations which translates to higher positive cashflow. The last sentence could also mean that you will be paying amortizations based on the value of the real estate at the time of purchase (so you peg the price). At the end of the payment period, the value of the property has already appreciated and you can profit from the appreciation when you sell the property. Hedging basically means that you buy low now and peg the purchase price because you anticipate that the value of the property you bought will appreciate later.

LOW INTEREST:

8% interest rates are usually available only for the first year and this is often not a fixed rate. This means at the end of the year your loan may be subject to “repricing” or adjustments in case the market interest rates have changed. What happens if a new financial crisis happens(God forbid) and interest rates shoot up? Then the interest rate of your loan shoots up as well along with your monthly amortizations, which can lead to negative cashflow situations and even more foreclosures. This is the reason why I often advice that one should always make sure that their interest rates are fixed for the longest possible term. By the way, other lending institutions like Pag-IBIG may offer lower interest rates (6% for loans up to Php400,000 and 7% for loans over Php400,000 up to Php750,000). I suppose transferring a loan from a bank to Pag-IBIG would be a good option in such cases.

EASY CREDIT APPROVAL:

Some banks use a Contract-To-Sell (CTS) wherein the Title of the property is not yet transferred to the buyer until the purchase price is paid in full. In contrast, if a property was bought through a mortgage loan, the Title is already transferred to the buyer and the same Title is then mortgaged to the bank. Because of this, the latter may require more stringent requirements. But still, even if a bank or a lending institution will be using a CTS, they would still do a credit investigation like checking a buyer’s capacity to pay, etc.

GOOD TITLE:

Banks are supposed to do due diligence before they accept a property as collateral for a loan so this is very true. Nevertheless, one should always do his or her due diligence even if one is buying a foreclosed property from a bank because sometimes foreclosed properties are involved in pending court cases (like the red tag foreclosed properties from BPI-Buena Mano) and these are annotated on the Title as a lis pendens (pending case). Always do your due diligence. At the minimum, one should get certified true copies of the Title plus traceback from the registry of deeds, etc.

IMMEDIATE APPRECIATION:

I believe what they were trying to say was one can get immediate appreciation in the form of instant equity (Equity is the difference between a property’s current appraised value /market value and the loan principal balance) if you are able to buy a foreclosed property at a price below market value. This is the essence of the statement “You make money when you buy, not when you sell” as often said by Robert Kiyosaki, author of Rich Dad Poor Dad. Just make sure that you really are buying a property below market value by doing your own property valuation.

Wednesday, March 10, 2010

BUSINESS : MONEY LENDING

Money lending business, (pautang or 5-6) has been one of the oldest business opportunities that has imbibed itself into the culture of Filipinos. If you ask someone whether he prefers to purchase a product with the total cash on hand or purchase it in installments with a 10% interest rate, he will most likely choose the installment plan. The simple reason? We like to see our money spent in small amounts rather than in lump sums.

Now while it is true that paying in installments is a good plan, the interest rate robs us directly from our bank account or wallet. But I'm not going to talk about buy and sell in this topic. I'm merely setting an example that is directly related to the money lending business.

The term 5-6 is derived from the interest rate that has been used in money lending business for a long time. By lending 5, we receive 6 in the end, which in total is actually 20% profit.

So what are the things you should be considering? For starters, how much are you willing to risk? I'm mentioning this because money lending business does not give you a 100% chance at profit. You will have to expect that sometimes, someone will not pay.

Let's say for example you decided to venture into this business and have an excess of 5,000. Two individual come to you. Both are asking to borrow 4,000. How will you divide your 5,000?

In money lending business, it is important for entrepreneurs to diversify. Lend 2,500 to each person rather than giving the full amount to only one. By doing so, you will get a lesser chance at losing. Even if one decides to run away, the other one will still profit you.

Now the next issue is to how long will it take for them to pay? Set a limit where you and your client can meet half way. Do not impose a specific time frame just because it is how you want it to be. Be lenient. I myself tried this and gave the person 15 days to pay me back only to have me wait for 15 days more. If you can willingly wait for a month, then that would give your client an ample time to earn and pay you.

What is your preferred interest rate? You can opt for the usual 20%/5-6 but to keep your client hooked, go for lesser rates. This will separate you from other lenders and at the same time, lessen the burden of your clients.

One thing I'd like to recommend to everyone venturing into money lending business is to have your client pay in at most 3 divided payments. the first payment should be the highest amount. Once this is done, your client will feel lighter when the succeeding two payments are made.

Keep your money cycling. Your 5,000 will get far. While others prefer that you take away a small percentage for your own, my advice is to keep everything moving. Lend it to other people, keep diversifying. If I decide to offer 10% interest rate a month, that will profit me 500 from my 5,000. If I get the full one year profit, I'd have received 220%, which is 11,000 (5,000 invested money + 6,000 profit).

Now that may be just a small amount but remember, you've already gained more than double your investment in just over a year by simply doing nothing, merely lending it to your clients.

Money lending business is naturally frustrating. While it is true that the return is quite high, the thought of going from one place to another, searching for your clients to pay on time, thinking if your money will still generate you income or simply disappear into thin air is just alarming.

In this business, you have to be a patient person. Someone who can't tolerate waiting will not survive or experience wealth in this venture. Learn how to wait, and how to do it with a smile on your face.

I made mention of examples that I consider my recommendations for this type of business. Understand that they are my opinions only and that you can formulate your own means of profiting from your invested money. Some offer 20% while others 10%. I made a 30 day limit for payments as an example, you on the other hand can opt for only 15 days.

How you decide on making profit or wealth will have a direct effect on the customers you attract and serve for a period of time. Take time to think about it. Ponder on the factors that can both benefit you and your clients.

At the end of the day, it will all boil down to one important thing, will your clients pay?

It is true that when someone is in need, they tend to become too emotional and end up trying to convince everyone to help them. That is a similar concept with the money lending business. Your clients will be the kindest persons on earth just so you will let them borrow your money. The problem comes when the expected date of payment comes and they are nowhere to be found.

We can only lessen the percentage of failing but not totally prevent it. Here are some factors you should consider about the person to whom you're going to lend your money.

1. Lend money to financially capable persons. There comes a time when someone doesn't have enough to spend on a particular period. They're not poor, just financially challenged at times. These are the types of clients you want to deal with. It is likely for them to pay you as compared to those who are financially unstable.

2. Do not add burden to an already burdened man. Someone who cannot sustain a stable income is still trying hard to survive financially. It is not the right time for them to borrow an amount that has an additional interest rate. They will most likely be unable to pay and may even run away with your money.

3. A collateral will help. If you can convince your client to leave a collateral until the whole amount is paid, then that will ensure the return of your investment and profit.

Always be wise in handling your money when venturing into money lending business. The profit and wealth obtained is high but the risks are higher.

Now while it is true that paying in installments is a good plan, the interest rate robs us directly from our bank account or wallet. But I'm not going to talk about buy and sell in this topic. I'm merely setting an example that is directly related to the money lending business.

The term 5-6 is derived from the interest rate that has been used in money lending business for a long time. By lending 5, we receive 6 in the end, which in total is actually 20% profit.

So what are the things you should be considering? For starters, how much are you willing to risk? I'm mentioning this because money lending business does not give you a 100% chance at profit. You will have to expect that sometimes, someone will not pay.

Let's say for example you decided to venture into this business and have an excess of 5,000. Two individual come to you. Both are asking to borrow 4,000. How will you divide your 5,000?

In money lending business, it is important for entrepreneurs to diversify. Lend 2,500 to each person rather than giving the full amount to only one. By doing so, you will get a lesser chance at losing. Even if one decides to run away, the other one will still profit you.

Now the next issue is to how long will it take for them to pay? Set a limit where you and your client can meet half way. Do not impose a specific time frame just because it is how you want it to be. Be lenient. I myself tried this and gave the person 15 days to pay me back only to have me wait for 15 days more. If you can willingly wait for a month, then that would give your client an ample time to earn and pay you.

What is your preferred interest rate? You can opt for the usual 20%/5-6 but to keep your client hooked, go for lesser rates. This will separate you from other lenders and at the same time, lessen the burden of your clients.

One thing I'd like to recommend to everyone venturing into money lending business is to have your client pay in at most 3 divided payments. the first payment should be the highest amount. Once this is done, your client will feel lighter when the succeeding two payments are made.